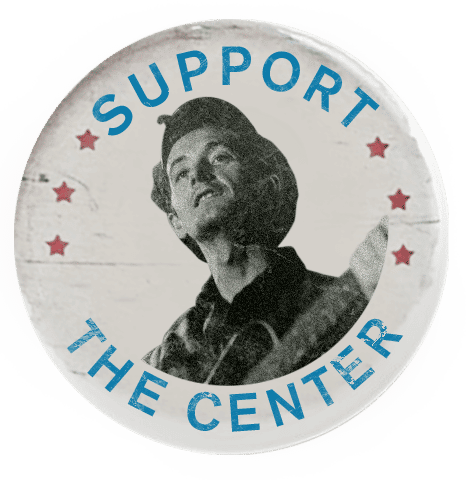

BEQUESTS & PLANNED GIVING

Planned gifts are an impactful way to help Woody Guthrie Center continue its efforts to celebrate the life, music and artistry of the influential folk musician while seeking to ignite a passion for social change and foster a world where the values of justice, equality and compassion prevail. Planned gifts secure the center’s future and legacy to inspire changemaking generations to come

There are many ways to make a gift to the Woody Guthrie Center. Choose the gift method below that works best for you. For more information, please contact Jessica McKenzie.

Thank you for your support.

Bequest from Will or Living Trust

You can create a legacy gift with a provision in your will or living trust that includes a specific dollar amount, asset or percentage of your residuary estate.

You may include a bequest to support Friends of American Song Archives for the benefit of Woody Guthrie Center when preparing your will or by adding a codicil to your present will. Bequests may be of cash, securities, real estate or other property. Bequests of all sizes are welcome, whether they are outright, contingent or residual. A bequest is deductible for federal estate tax purposes and bequests are generally not subject to state and inheritance taxes.

Sample Bequest Language:

Specific Bequest:

“I bequeath the sum of $____________ of my total estate assets to Friends of American Song Archives, Inc., federal tax ID number 46-5165090, for the benefit of Woody Guthrie Center (102 E Reconciliation Way, Tulsa, OK 74103), its operations and mission.”

Residual Bequest:

“I bequeath ________ percent of the residue of my total estate assets to Friends of American Song Archives, Inc., federal tax ID number 46-5165090, for the benefit of Woody Guthrie Center (102 E Reconciliation Way, Tulsa, OK 74103), its operations and mission.”

Contingent Bequest:

“In the event that ________________ predeceases me, I bequeath the sum of $____________ (or, alternatively, ________ percent of the residue of my total estate assets) to Friends of American Song Archives, Inc., federal tax ID number 46-5165090, for the benefit of Woody Guthrie Center (102 E Reconciliation Way, Tulsa, OK 74103), its operations and mission.”

To make Woody Guthrie Center the beneficiary of a planned gift you only need the following information:

“Friends of American Song Archives for the benefit of Woody Guthrie Center”

Woody Guthrie Center

Attn: Development Office

102 E Reconciliation Way

Tulsa, OK 74103

Federal Tax ID: #46-5165090

Choosing to make Friends of American Song Archives, Inc. a part of your estate plans can help you realize financial and/or tax-saving benefits. Please speak with a financial advisor or attorney for advice. We are also happy to provide you with individual assistance and information, in confidence and without obligation.

To request more information or to talk about a bequest, please contact Jessica McKenzie, Senior Director of Development & Finance.

Register Your Bequest

If you have included Friends of American Song Archives, Inc. on behalf of the Woody Guthrie Center in your will or estate plans, please fill out this form to let us know so that we can express our gratitude. If you prefer that your plans remain private, we thank you for your thoughtful commitment and generosity.

Additional Planned Giving Opportunities

Do you have an IRA, 401(k), life-insurance policy or any other assets not included in your will? If so, these are called non-probate assets and you must plan your beneficiaries for them separately. If bequeathed to Friends of American Song Archives, Inc., these funds would escape income and estate taxes and reduce the size of your total taxable estate.

Gifts From Your Retirement Plan or IRA

If you are 70 1/2 or older, you are eligible to make tax-free contributions to Friends of American Song Archives, Inc. for the benefit of Woody Guthrie Center from your IRA or other qualified retirement plan (e.g., pension funds, 401k, 403b, etc). The donation counts towards your Required Minimum Distribution or RMD (the IRS-determined minimum amount you must withdraw from your account each year). To learn more, consult your individual plan administrator and ask for a beneficiary designation form.

Charitable Remainder / Lead Trusts

A Charitable Remainder Trust (CRT) is created by a transfer of assets to a trust that will pay you or another beneficiary income for life or for a period of time. At the death of the last beneficiary, the remaining property in the trust passes to Friends of American Song Archives, Inc. for the benefit of Woody Guthrie Center. A CRT provides lifetime income to you and/or your loved ones and offers significant tax advantages.

A Charitable Lead Trust (CLT) is created by a transfer of assets to a trust that will pay income to Friends of American Song Archives, Inc. for the benefit of Woody Guthrie Center for a term of years. At the end of the term, you or a beneficiary receive the remaining trust assets. A CLT can be created during life or at death under the terms of your will. It’s a great way to transfer assets to future generations, realize tax advantages and benefit the Woody Guthrie Center today.

Life Insurance

Donate a paid-up life insurance policy which has outlived its original purpose and receive a tax deduction. Simply name Friends of American Song Archives, Inc. as a beneficiary of a life insurance policy.

To make Woody Guthrie Center the beneficiary of a planned gift you only need the following information:

Friends of American Song Archives for the benefit of Woody Guthrie Center

Attn: Development Office

102 E Reconciliation Way

Tulsa, OK 74103

Federal Tax ID: #46-5165090

Savings, Checking, Brokerage or Transfers on Death

Name Friends of American Song Archives, Inc. as a beneficiary of a savings, checking, brokerage or other transfer on death account.

To make Woody Guthrie Center the beneficiary of a planned gift you only need the following information:

Friends of American Song Archives for the benefit of Woody Guthrie Center

Attn: Development Office

102 E Reconciliation Way

Tulsa, OK 74103

Federal Tax ID: #46-5165090

Real Estate

Donate appreciated real estate that is not subject to a lien or mortgage.

Qualified Charitable Distributions

If you are 70 ½ years old or older, you can make a Qualified Charitable Distribution (QCD) from your Individual Retirement Account (IRA) directly to Friends of American Song Archives, Inc. for the benefit of Woody Guthrie Center without the distribution counting as taxable income. Up to $100,000 in taxable IRA funds can be counted as QCDs annually for individuals (up to $200,000 for married couples). This can be a tax-efficient way to give. In addition, a QCD can be used toward your required minimum distribution.

QCD checks may be made out to Friends of American Song Archives with a memo line of “Woody Guthrie Center” and mailed to:

Woody Guthrie Center

Attn: Development Office

102 E Reconciliation Way

Tulsa, OK 74103

QUESTIONS

If you have questions, or would like to discuss how you can best support the Woody Guthrie Center through a planned gift, please contact Jessica McKenzie, Senior Director of Development & Finance.